How a low cost Indian car manufacturer changed the fortunes of two premium British brands

The story of Jaguar Land Rover turnaround is quite a remarkable one given the short time frame in which the company returned to profits. Tata Motors succeeded where MNC’s like BMW and Ford motors failed. Initially critics had doubted Tata’s ability to manage such a premium and iconic brand, fearing that the Indian ownership will hurt the premium tag of the company. People couldn’t understand how a commercial and small car manufacturer will turn around the fortunes of premium marquee brands like Jaguar and Land Rover. Hence, the story is also of importance to the India growth story as it highlights how strong the management abilities of Indian companies are.

The June 2008, $2.5 billion acquisition couldn’t have come at a worse time for JLR and TATA Motors as the mortgage market in US collapsed leading to a global slump. Those who had money didn’t want to lend it to anyone. TATA Motors found itself saddled with a debt of around Rs. 21,900 cores, a tricky proposition for a company which had been relatively debt free. Unemployment and credit crisis meant lower sales in the critical markets of US and Europe. JLR needed a lot of cash but the recession made things worse for them. So bad was the situation that JLR even tried to approach the UK government for a probable bailout. At the height of the crises TATA Motors shares dropped to a low of Rs. 126.45 valuing the company at $ 1.5 Billion, fraction of what it paid Ford to acquire JLR

In FY2009 TATA Motors reported its first annual loss in the last seven years. It recorded a loss of Rs. 2,500 crores compared to a profit of Rs. 2,200 crores in 2008. The JLR unit made a pre-tax loss of Rs. 1,800 crores on the back of poor demand in crisis hit US and Europe.

Two years down the line those hard days seem very distant. JLR has been generating profits for several recent quarters. It now contributes to over 50% of the revenue of TATA group. The new launches have worked very well. Sales in China have surged contributing to the growth in revenue. Sales in US and Europe have also seen a healthy rise. Tata Motors current market capitalization is approx $13.87 billion(as per closing value of stock on 23.01.2012)

The Acquisition

It was first in 2007 that Mr. Ratan Tata and Mr. Ravi Kant (CEO TATA Motors) were given a brief about JLR by Ford. Mr. TATA asked his senior employees whether this acquisition would make sense. To decide on the acquisition Mr. Tata and Mr. Kant set off for US and UK to check whether these two brands still held sway in the market. In US they met dealers, who had been having hard time since long. However, these dealers expressed their faith in the brand to Mr. Tata. Next came the dealers in UK, they too held a similar view of the brand. This reassured TATA Motors that the brand of Jaguar and Land Rover was still strong in the market. Once assured of the brands power TATA Motors set on nine month long due diligence process culminating in TATA Motors acquisition of Jagaur and Land Rover marquee brands from Ford.

Bringing in the change

At the start itself Tata Motors realized that two things that needed urgent attention at JLR were cash management and cost reduction. The company was finding hard to get credit during the crisis time and hence cash was the top most priority for the TATA Motors. Since JLR didn’t have a cash management system of its own, TATA hired KPMG to implement one for them. They began managing cash on an hour to hour basis.

The next priority issue was cost management. To meet this end, Munich based Roland Berger Strategy Consultants was hired. They implemented a three pronged plan. First, a system for the managing cash and liquidity was put in place with the assistance of KPMG. Secondly, they developed a broad cost reduction plan and created almost 10 – 11 cross functional teams to handle these assignments. There was also a lot of change in the top management at JLR, with new heads coming in to the company.

Lastly a long term plan was formulated to run up to 2014 which focused on new model development and refreshing the existing models. TATA put up a young team of managers to lead these initiatives just like it had done during the restricting of TATA Motors in 2003. Also the parent company conducted daily reviews to keep check on the progress made.

The parent company also pumped capital in to JLR to tide over the problem of liquidity and to ensure that new model development programs continued as planned. TATA Sons divested its stake in a few group companies to raise cash for JLR. It was Mr. Ratan Tata’s conviction in JLR that made him take such bold decisions. All funds raised through these routes were channelized in to JLR.

Focus was also put on reduction the workforce at JLR. At the time of takeover the workforce of JLR was a humongous 27,000. Within a year the workforce was reduced by almost 11,000. Some external events like a favorable exchange rate and demand hike in China also helped JLR to clock better revenue figures.

Tata Technologies, a subsidiary of Tata Motors was handed over the work to separate JLR’s IT systems from those of Ford. This initiative also helped JLR save millions of dollars on IT.

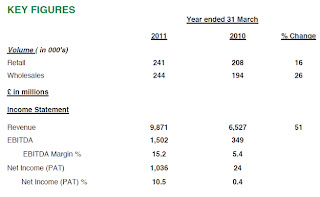

The below table shows the amazing turnaround, in FY 2010-11 the net profit for JLR was 1,036 million pounds compared to a net profit of 24 million pounds in FY 2009-10.

The road ahead

The all new Range Rover Evoque was launched in September 2011 and has received very exciting reviews; it has helped JLR to acquire new customers. It has also announced plans to set up a 355 million pound state of the art facility in Wolverhampton, UK to produce new low emission engines. Today almost 38% of JLR’s revenue comes from the BRIC nations and it plans to increase this figure further.

Tata’s turnaround of JLR has become folklore in management circles. It shows how a committed management can bring about a change where everyone else has failed before. It also highlights the coming of age of India’s business houses; aggressive, ready to take on the world’s best.